How to Forecast

As a VP of Sales, I had the pleasure (pain) of trying to forecast in the middle of an economic downturn. Before the economy turned, most deals trending toward a "yes" from your champion would default to Closed Won. After it turned, it didn't matter if your champion said yes, because your champion might not even be there tomorrow.

Not only that, we were dealing with a team that had doubled in size over the last 6 months, so all of the reps were relatively new and still calibrating their compass.

So here were the steps we took to make sure everyone's deal compass was pointing in the same direction. It's going to vary for your company, but the principles will hold true.

Know your categories

For some organizations, "commit" means the lowest possible number you can possible call without changing your same to Sandbag Sam. For other teams, "commit" is a more accurate representation of where you think you will land.

In my past two leadership roles, our forecast categories looked something like this:

- Worst: The world burns down. This often means deals in vendor review with clear timelines to close. This number should never go down.

- Commit: If you had to bet, where you would land... minus 10-20% for conservatism. This number should go up 80% of the time.

- Best: If the swings land favorably, you land here. Note: This is not every single deal in your pipeline.

Once you have your definitions, you can now assign deals to categories.

Map Deals to Categories

This is where the money is made. You now need to plot each deal in each category based on the risk you see. If your team is a MEDDPICC or a BANT team, again, use that qualification criteria and align to your organization's methodology.

I personally like to think about risk as a function of two questions:

- Will It Close? How well have I achieved the exit criteria in each stage?

- On Time? How likely am I to complete the next steps on time?

It sounds simple and that's by design. Because the complexity comes from the exit criteria that I already know need to happen at every stage of the deal.

Example: Best Case Call

Let's do an example. If these are my sales stages and exit criteria are below...

- Disco: Did they agree to a problem?

- Demo: Did they agree to a solution?

- Multithreading: Did power agree to the problem and solution?

- Proposal & Negotiation: Did they put money behind the solution?

- Vendor Review: Did they sign?

A "Best Case" Deal would look like this:

Strength of Exit Criteria

- 🟢 Disco: Dir. of Content agreed to a board-level problem with urgency to solve it.

- 🟢 Demo: The prospect explicitly stated we beat out the competition.

- 🟢 Multithreading: CMO agrees agrees we can solve the board-level problem.

- 🟡 Proposal & Negotiation: Y/N meeting with procurement next week. We're vendor of choice, but $20k above their budget and not the only ones who can do the job.

- Vendor Review: N/A, not here yet

Timeline: 2 months to close with a compelling event

While I have ample time to close the deal, I can't commit a deal like this until I get a clear "yes" on the problem, solution, and the cost to solve it...

But if I had three of these deals... I might be comfortable committing one of them if there was ample time in the quarter to close.

Example: Commit Call

Let's say we flip that 4th stage to green... but tighten the timeline:

Strength of Exit Criteria

- 🟢 Disco: Dir. of Content agreed to a board-level problem with urgency to solve it.

- 🟢 Demo: The prospect explicitly stated we beat out the competition.

- 🟢 Multithreading: CMO agrees agrees we can solve the board-level problem.

- 🟢 Proposal & Negotiation: Our CMO has secured budget.

- 🟡 Vendor Review: In the legal queue. Prospect confirmed legal takes 2 weeks.

Timeline: 4 weeks till EoM

This is a commit, but I've gotta stay all over it. This needs to be coupled with explicit agreement from their legal team and acknowledgement from the buyer that their price goes up if they miss their time commitment...

It is very likely that this deal will close at some point -- but committing a deal means locking it down on both certainty and certainty right now.

Example: Worst

Let's say we flip that 5th stage to green...

Strength of Exit Criteria

- 🟢 Disco: Dir. of Content agreed to a board-level problem with urgency to solve it.

- 🟢 Demo: The prospect explicitly stated we beat out the competition.

- 🟢 Multithreading: CMO agrees agrees we can solve the board-level problem.

- 🟢 Proposal & Negotiation: Our CMO has secured budget

- 🟢 Vendor Review: 1st cuts back. Minimal redlines and legal to legal call pre-scheduled for next week to wrap things up.

Timeline: 4 weeks till EoM. Customer must sign to meet upcoming product launch.

This is the only version where I'm comfortable calling it a worst case deal. We've crushed all of our exit criteria and have a compelling event driving the ship... and the process is locked in with a legal-to-legal call two weeks ahead of schedule.

A note on "playing the spread"

You might've noticed that I did this in my best case deal -- I mentioned that if you have 3 deals in my best case, I might be comfortable calling 1 as a commit if it were early in the quarter.

You're gonna look like a total goon if you have a massive pipeline and call your commit $0 just because you don't have a single deal in active redlines. Place each deal within the appropriate forecast categories, then make your actual forecast calls based on how much inventory is sitting in each category to account for probabilities and risk.

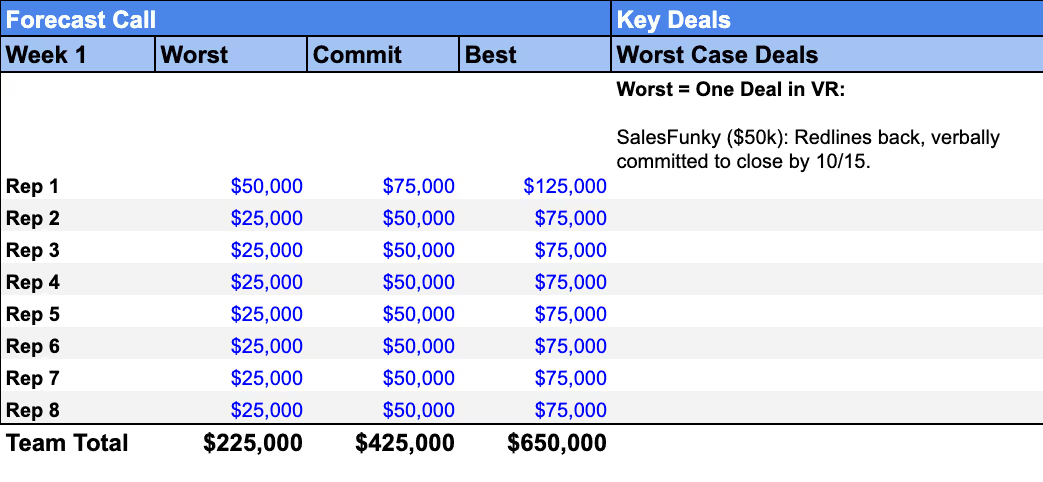

That's a wrap folks! If this was helpful, you can steal this forecasting template that I've used in the past to roll-up my team's rep-by-rep forecast.